Can You Get Cheaper Car Insurance Over the Phone

One of the most expensive mistakes you can make with your car insurance is letting your policy automatically renew.

If you do this instead of looking for a better deal, your insurer can take advantage and push your premiums up.

So shopping around is one of the best ways to get a cheaper deal on your car insurance.

Follow our other top tips to drive the cost down even further.

1. Limit your mileage

Limit the number of miles you drive each year - fewer miles means you're a lower risk for insurers, so cheaper to insure.

But always give an accurate estimate of your mileage when getting a quote - your policy could be invalid if you're not honest.

2. Pay annually

Paying monthly for car insurance is a loan, with interest added, so paying for your car insurance in a lump sum is cheaper.

If you can't afford to pay in one go, it's worth considering other options such as paying on a 0% credit card - just make sure you make at least the minimum monthly repayments and pay off the balance on the card before the interest-free period ends.

3. Improve security

Improving your vehicle's security could get you cheaper premiums.

Think about installing devices such as alarms, immobilisers and locking wheel nuts.

Get quotes on how much your insurance would cost before fitting any security upgrades, so you can see if the extra cost of them is worth it for the insurance savings.

4. Increase your voluntary excess

Choosing a higher voluntary excess when you take out your policy will reduce the price of your insurance.

But if you make a claim you'll have to pay that excess towards the cost of repairing or replacing your car - so be certain you can afford the excess if you do end up having to pay it.

5. Build up your no claims bonus discount

Building up your no-claims bonus discount will help you to get a cheaper policy because insurers reward motorists who are claim-free with discounts on their premiums.

6. Only pay for what you need

Don't choose a more expensive policy with unnecessary add-ons - go for one that has everything you need for a great price. Comparing insurance should help you find the right insurance for the right price.

7. See if it's cheaper to buy add-ons as separate products

Car insurance add-ons can include:

- legal assistance

- courtesy car cover

- personal accident cover

- windscreen cover

- protected no-claims bonus

8. Consider your cover type

If you have an older car that isn't worth very much, a third party, fire and theft policy rather than comprehensive cover could save some money.

But third party-only insurance might not offer the cover level you want, and it isn't always cheaper than comprehensive cover.

9. Park with care

If you have a garage or driveway, park your car there overnight.

Parking off the road overnight could lower the chance of your car being vandalised or stolen, and insurers will deem you as less of a risk to insure, potentially lowering your premiums.

10. Take care with extra drivers on your policy

Putting an additional driver on your policy can bring your premiums down, if they're experienced.

Always be honest about who the main driver is though, or you'll invalidate your cover.

11. Think about what vehicle is best for you

Cars which have a small engine are more likely to be in a low insurance group and tend to have lower premiums. For example, a 1.1 litre hatchback would be cheaper than an SUV with a large engine.

Road tax on a smaller engine vehicle should also be cheaper.

Every insurer will treat every sort of vehicle differently though. For example, some classic cars are very affordable to cover as insurers recognise the love that owners put into them and you may find a discount through an owners' club.

12. Avoid modifications

Modifications - whether they're upgrades to styling, audio or performance - could mean a big hike in the price of your insurance.

Adding alloy wheels, body kits and performance upgrades could make your car a lot more attractive to thieves.

Modified cars also tend to be more expensive to fix than ordinary cars due to the expensive parts.

13. Take a driving course

Although advanced driving courses such as Pass Plus and IAM cost money, they'll get you a discount on your insurance with some providers, especially for young and inexperienced drivers.

Bear in mind that some insurers won't take courses like these into account, and you should weigh up whether the savings on insurance will outweigh the course cost.

14. Think about how you describe your job

If, for example, you don't commute, you may be able to find a cheaper policy by describing your insurance as being 'for social use'.

The way you describe your job can also affect your premium. While a 'chef' might pay a different premium to a 'cook', and a 'hairdresser' might pay a different price to a 'barber'.

But be honest or you risk invalidating your policy.

Also think about the level of business use cover you need, if your vehicle is for business use, you must be honest or you'll invalidate your cover.

15. Consider a telematics policy

Telematics car insurance bases premiums on actual data about your driving, which is recorded by either a black box fitted in the vehicle or a mobile phone app.

As an added bonus the black box acts as a tracker if your car gets stolen.

Telematics insurance can make your car insurance cheaper, whatever your age, as long as you're a careful driver.

16. Pay attention to administration charges

Administration charges are one of the great hidden expenses on car insurance.

If, for example, you change your car, your job or your address, some policies will allow you to make the change for free - but others could charge around £50.

Take charges into account when you arrange your insurance - paying £5 or £10 more for a policy with reasonable admin fees could save you much more in the long run.

17. Shop around for the right quote

You won't be surprised to hear that our top tip for getting the car insurance cover you need at the right price is to shop around.

It might seem like less hassle to just let your insurance auto-renew with the same provider each year, but you could save up to £257 by comparing.[1]

It doesn't have to take a long time to check whether you could get a cheaper deal - just compare car insurance quotes with us.

Shopping around individual insurer websites, phoning them all up or using a high-street broker is time-consuming. Compare prices with us and you'll have lots of quotes to choose from in minutes.

18. When to renew your car insurance for the best price

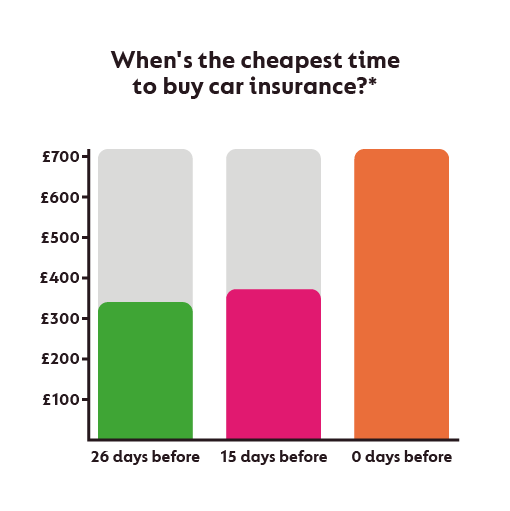

You can buy your car insurance up to 29 days before the policy start date and 'lock in' the price you're quoted on that day.

And our research shows it's better to buy early. The closer to renewal date you get, the more you could end up paying for your premiums.

Our customers saved over 40% on average by buying their car insurance 26 days before their renewal date, compared with those renewing on the day.*

Insurers can change their prices at any time, so the price you see when you first compare quotes might change if you return to buy later.

*Average premium paid by all customers over the age 18, for annual fully comprehensive car insurance policies bought through GoCompare between January and December 2020.

Can You Get Cheaper Car Insurance Over the Phone

Source: https://www.gocompare.com/car-insurance/guide/top-tips-for-cheaper-car-insurance/